nevada estate tax rate 2021

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. The exact property tax levied depends on the county in Nevada the property is located in.

Counties cities school districts special districts such as fire.

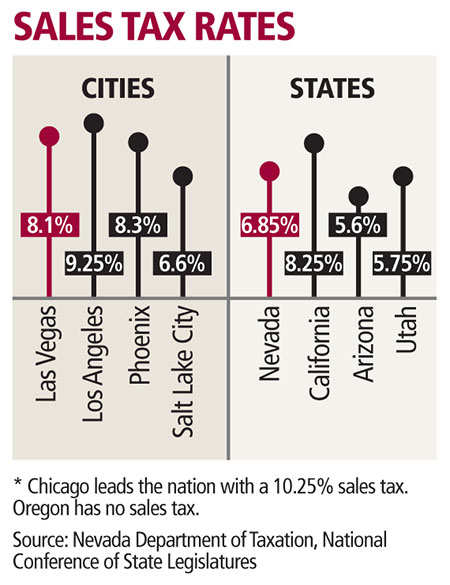

. Washoe County collects the highest property tax in Nevada levying an average of 188900 064 of. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement.

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments. Clark County collects on average 072 of a propertys assessed fair.

NRS 3614723 provides a partial abatement of taxes. 31 rows The latest sales tax rates for cities in Nevada NV state. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300.

Rates include state county and city taxes. Click here to view the current tax district map. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date.

2020 rates included for use while preparing your income tax. Property tax bills are mailed sometime in July of each year for both Real and Personal Property. Nevadas tax system ranks.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Corporate Taxes Do Businesses Pay In Nevada Llb Cpa

Where Not To Die In 2022 The Greediest Death Tax States

Death And Taxes Nebraska S Inheritance Tax

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Death And Taxes Nebraska S Inheritance Tax

Nevada Sales Tax Guide For Businesses

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

California Income Tax Calculator Smartasset

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

General Sales Taxes And Gross Receipts Taxes Urban Institute

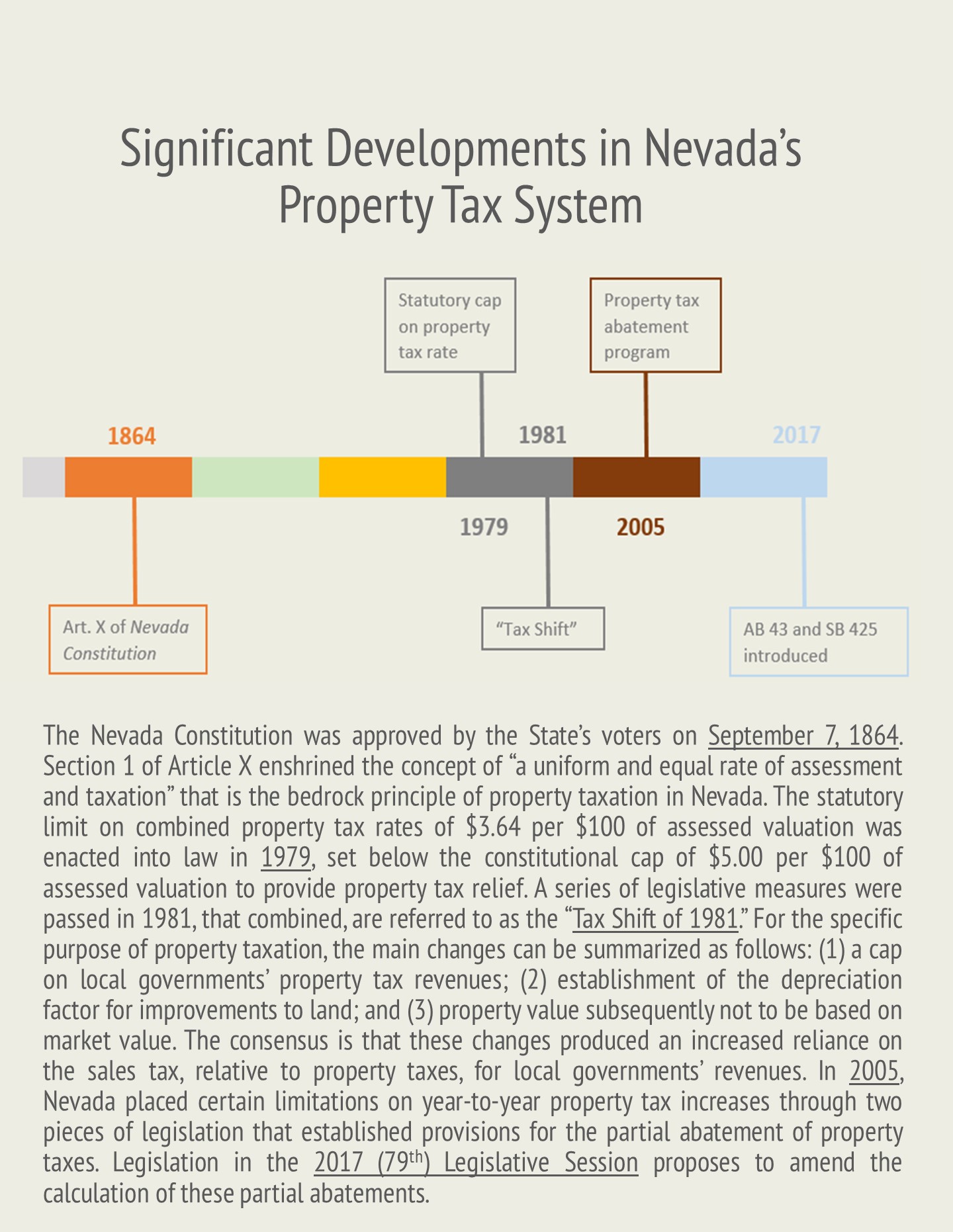

Property Taxes In Nevada Guinn Center For Policy Priorities

What Is The U S Estate Tax Rate Asena Advisors

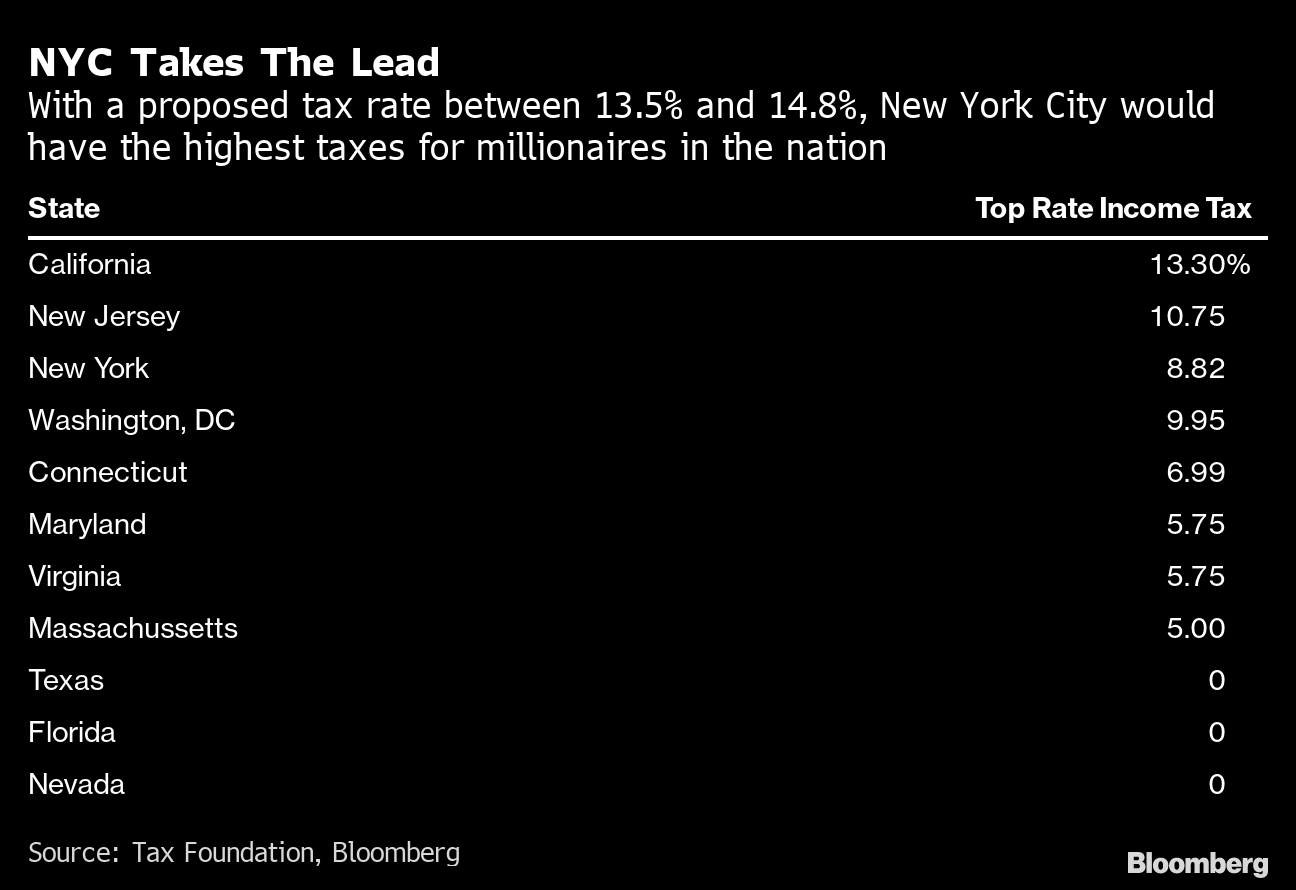

Nevada Vs California Taxes Retirepedia

.png)